iowa vehicle tax calculator

The tax is imposed on the total amount paid for the property. To view the Revenue Tax Calculator click here.

Sales Tax On Cars And Vehicles In Iowa

As of July 1 2008 Iowas sales tax increased from 5 to 6.

. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax. What is Transfer Tax. Uh oh please fix a few things before moving on.

Sales taxes are used to support the state much like state. The other taxes specific to Arizona are the Title tax of 4 the Plate Transfer tax of 12 and the Registration tax. If you know the Year Make and Model key in.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership. Just enter the five-digit zip code of the. The tax is paid to the county recorder in the.

Online Calculators Financial Calculators Iowa Car Loan Calculator Iowa Auto Loan Calculator. If you itemize deductions a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2014 may be deducted as personal property tax on your. To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625.

Standard minimum fee for the vehicle type applies. Notating and releasing security. Iowa Real Estate Transfer.

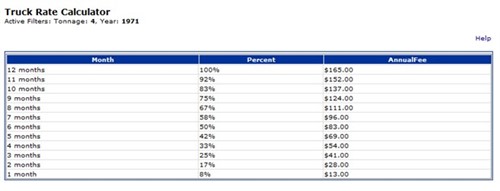

Join the Department for our free monthly tax. For example if you purchased a car with a sales price of. The number of credited months and the estimated credit appear under.

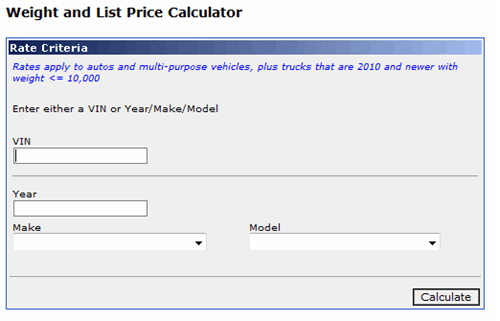

Average DMV fees in Iowa on a new-car purchase add up to 354 1 which includes the title registration and plate fees shown above. If you know the VIN Vehicle Identification Number of the vehicle key in VIN must be 17 digits Press Calculate. The County Treasurer is responsible for issuing vehicle titles registration renewals junking certificates personalized and other special emblem plates.

If an allowable deduction was limited and added back for Iowa purposes in 2018 because of Iowas lower contribution limitation you may recalculate your Iowa contribution carryforward. Iowa has a 6 statewide sales tax rate but also has. Iowa Auto loan calculator is a car payment calculator with trade in taxes extra payment and.

IDR has issued new income withholding tax tables for 2022 including an updated withholding calculator. Page 5 of 9 3 Enter the sale date registration end date and annual registration fee for the vehicle. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This is equal to a percentage of Iowa taxes paid with rates ranging from. In our calculation the taxable amount is 35250 which equals the sale price of 39750 minus the trade-in value of 2000 minus the rebate of 2500. Load full table of contents.

To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625. Iowa Income Tax Calculator 2021 If you make 70000 a year living in the region of Iowa USA you will be taxed 12248. Our calculator has recently been updated to include both the latest Federal Tax Rates.

Antique Vehicles - Motor vehicle 25 years old or older. Step 1- Know Specific Tax Laws In Arizona the sales tax for cars is 56 but some counties charge an additional 07. UT 510 Manual pdf Vehicle Rental Sales Use and Automobile Rental Tax.

Your average tax rate is 1198 and your marginal tax rate is 22. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202122. Standard MVD fees are about 412 on a 39750 vehicle and are calculated from a percentage of the vehicles value added to a weight fee.

All car sales in the state of Iowa are subject to a 6 sales tax at the state level and up to 1 sales tax for county and local rates. Leased Vehicle Worksheet 35-050 Leased. Please select a county to continue.

This feature is used to determine registration fees by vehicle identification number or by selecting make year and model. A Brief Description of Motor Vehicle One-time Registration Fee. Some cities can charge up to 25 on top of that.

This 6 rate is applied to goods that are sold within the state of Iowa. For example if you purchased a car with a sales price of. Iowa Documentation Fees.

PurchasedTransferred on or after January 1 2009. Click Tools then Dealer Inquiry then Fee Estimator.

Tax Title And License Calculator Iowa

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Vehicle Registration Calculator

Car Payments Calculator Car Affordability Calculator Nadaguides

Iowa Vehicle Registration Calculator

Tax Title And License Calculator Iowa

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Iowa Car Registration Everything You Need To Know

Iowa Vehicle Registration Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price